"What You Need To Know"

4 Reasons To Check Your Business Credit Scores

Research found that 72% of business owners don’t know their business credit scores. If you’re one of those who don’t know their scores, here are four great reasons to check your business credit on a regular basis:

Business Credit Builder - Tips to Avoid Credit Errors.

Credit is a complicated creature. The second you think you have it figured out, it turns on you. Truly, if you don’t handle it just right, it can morph from powerful ally to mortal enemy in a flash. This is especially true if you are trying to run a business.

6 BUSINESS CREDIT SECRETS EVERY COMPANY SHOULD KNOW

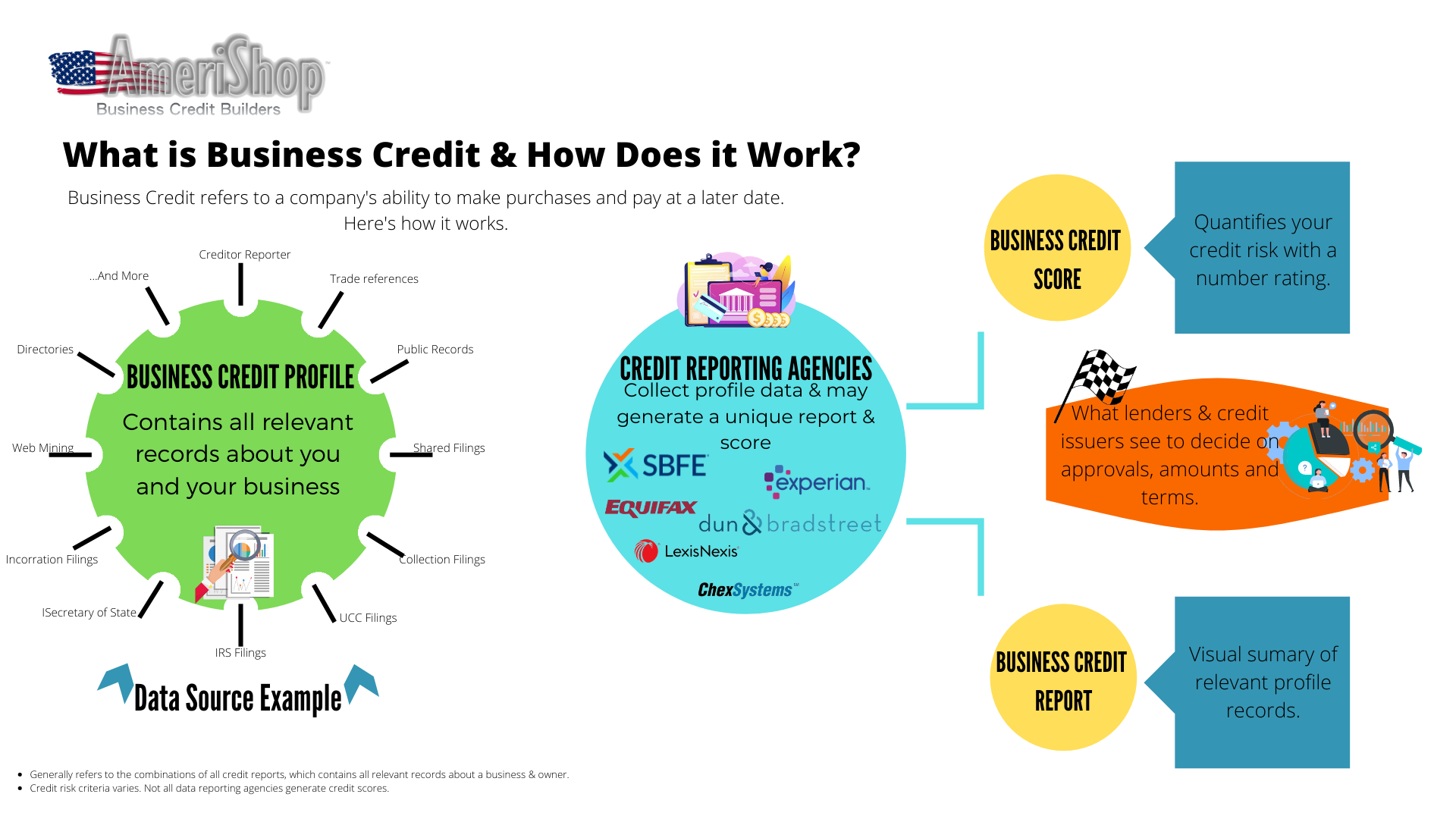

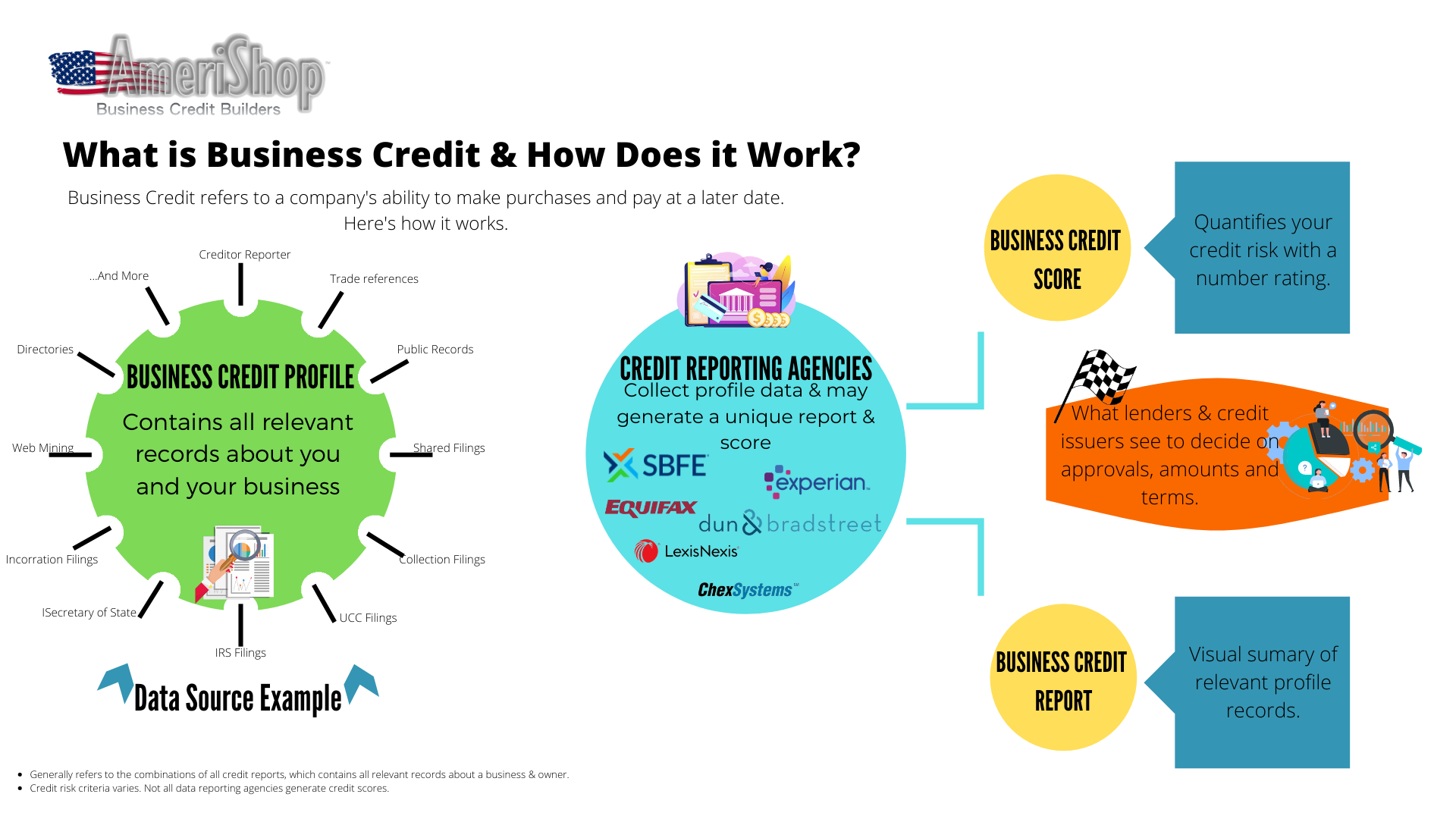

Business Credit is credit obtained in a Business Name. With business credit the Business builds its own credit profile and credit score. With an established credit profile and score, the business will then qualify for credit. This credit is in the business name and based on the business’s ability to pay, not the business owners. Since the business qualifies for the credit, in some cases there is no personal guarantee required from the business owner.

How to build my business credit?

If you’ve ever taken out a consumer loan then you probably already know how your personal finances and credit works.You likely understand where your personal credit score lands month- to-month and how debilitating a poor credit score can be.

While you may be aware of how your personal credit score works you might not be familiar with how your business credit rating functions. As a business owner, your business credit rating can significantly impact your financial reputation.

Business Credit Builder - Tips to Avoid Credit Errors.

Credit is a complicated creature. The second you think you have it figured out, it turns on you. Truly, if you don’t handle it just right, it can morph from powerful ally to mortal enemy in a flash. This is especially true if you are trying to run a business.

6 BUSINESS CREDIT SECRETS EVERY COMPANY SHOULD KNOW

Business Credit is credit obtained in a Business Name. With business credit the Business builds its own credit profile and credit score. With an established credit profile and score, the business will then qualify for credit. This credit is in the business name and based on the business’s ability to pay, not the business owners. Since the business qualifies for the credit, in some cases there is no personal guarantee required from the business owner.

NO!

Nobody likes to hear the word “no” when it comes to getting what they want, especially business owners. Don’t send your clients away because they can’t qualify for business financing. Help guide them to the financial solution they need and can help them qualify for a bank loan.

Get Credit for Your EIN that’s Not Linked to Your SSN

To run and build your successful business, you need to qualify for loans and credit lines at the best loan rates possible. Business credit is essential to make this happen, and it helps you access money even when you can’t qualify for a loan.

Build Your Business Credit

Your business credit score is one of the most important factors that lenders consider when qualifying you for a business loan. The lower your score, the harder it will be to get the financing your business needs, and with so many variables that affect your score, it can be difficult to keep up. So what can you do as a business owner to improve your business credit score?

Why should you start building credit for your business now?

Establishing your credit history from the moment you start your business is definitely an advantage. The longer you have your credit history, the more secure banks and credit institutions will be of your ability to meet your payment obligations,so you may wonder why is this important?

Frequently Asked Questions About The Importance Of Having Good Credit

To further drive the point of how important having a good credit score is, I’m sharing with you some common questions business owners have regarding credit.

Business Credit Scores Are Vital

As a small business owner, it’s vital to establish a good credit score. This is especially crucial when starting a business, as you likely won’t have enough cash on-hand to afford all your business expenses. This includes startup costs like equipment, advertising, inventory, and payroll.

USE A BUSINESS CREDIT CARD TO GROW YOUR BUSINESS

According to a study by the firm Mercator Advisory Group, in 2015 there were about 13.9 million credit cards held by small businesses in the United States. The report also indicates that the expenses of these companies with this means of payment amount to $430 billion dollars.

BUSINESS CREDIT BUREAUS: WHAT ARE THEY AND HOW DO THEY WORK?

Getting a loan for your business can be hard, especially if the business credit bureaus have assigned you a low rating.Based on the data collected from banks, credit card companies, suppliers, and other sources, business credit bureaus create your business credit report. This report displays your company’s credit score, an indicator of your financial solvency.